Incorpation and Tax Exemption

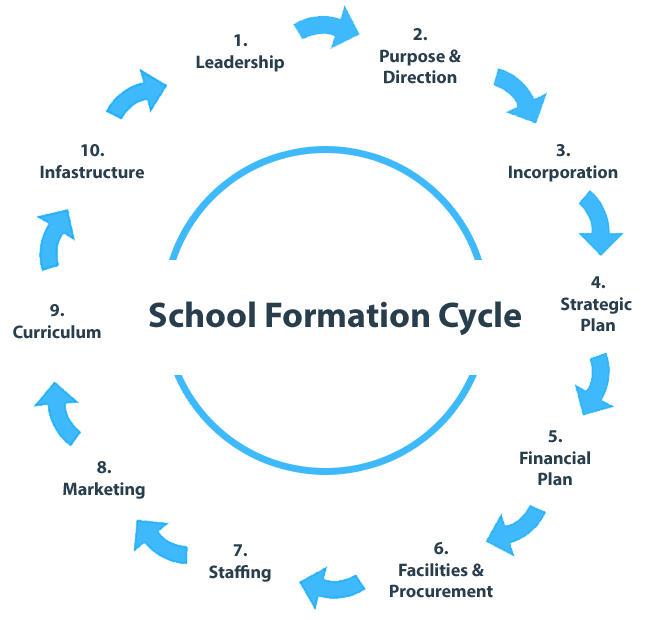

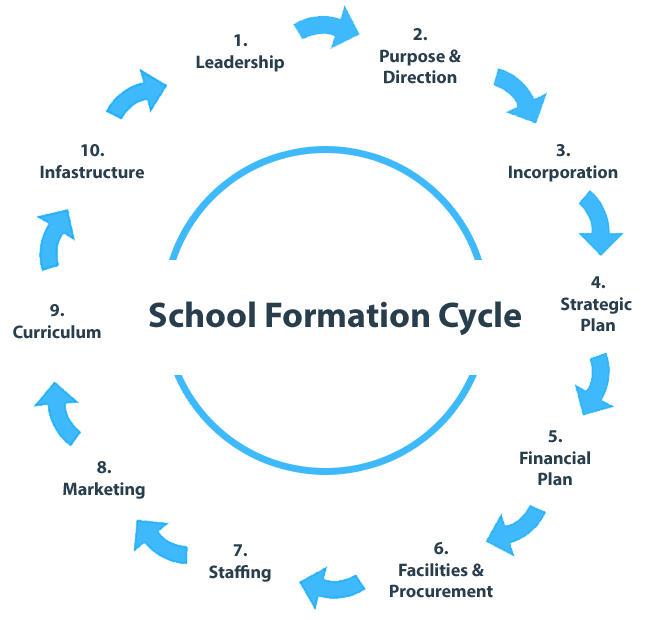

Are your School Founders up for the challenge? The mechanics of starting a school can be challenging. In today’s complicated environment, the need to work smarter and be ready for the day-one of school opening is critical. With proper planning, founders can be prepared to start the school of their dreams and manage costs and project development effectively, establishing a school for generations to come. Provided herein are our time-tested stages for starting a school.

In Stage 3, you need to file for your incorporation/society papers with the appropriate Province or State agency. The lawyer on your Steering Committee will deal with this. Establishing incorporation will limit liability in the case of lawsuits, create a stable image, extend the life of the school beyond the founders, and provide an insurable entity. A 3rd party lawyer should be consulted. Submit as early in the process your tax exemption application with appropriate authorities to obtain your non-profit status. You can then begin to solicit tax deductible donations.

Next Step

If you are interested in our school formation consulting services and would like to receive written material about HEG, or would like to discuss your particular needs, please contact HEG directly to find out more about our services. You can set this up by sending an email to info@halladayeducationgroup.com or calling directly at +1-800-687-1492. We invite you to continue browsing our web site.

Provided below is an overview of our time-tested school formation stages that HEG follows to start a new private school. Click on each stage to find out more about